There are thousands of cross-border workers in the Lake Constance and Breisgau region who choose to combine the best of two worlds: they live in Germany and work in Switzerland. Salaries are higher in Switzerland and taxes and social security contributions are lower. In Germany, rents and living costs are much lower.

Who can be a cross-border worker?

Germans and other EU- and EFTA citizens who are entitled to work in Switzerland are permitted to live in the border region as long as they regularly return to their homes after work.

Who can become a cross-border worker?

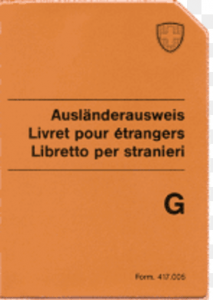

The first requirement for obtaining a cross-border work permit is to have a work contract with a company in Switzerland. After signing the contract, either you or your employer must apply for a G work permit with the appropriate authorities. These may vary from canton to canton or even, in some cases, from towns to communes within the canton. Even though the procedure is not exactly the same all over Switzerland, the rules for obtaining a G permit are similar wherever you apply for it. The authority in charge is the Cantonal Office for Migrations; in some places, this may still be called the „Fremdenpolizei“ (en: foreign police). Your employer usually sends you the form together with your work contract. Alternatively, you can download it from the Cantonal Office’s website.

This form must be sent in together with a copy of your work contract, a certificate of registration from your municipality of residence and a passport photograph. Processing your application takes around two to three weeks and the work permit is then sent directly to your employer who will pass it on to you.

In most cantons/communes your employer must register your employment before you begin work. The cross-border work permit should usually be applied for in advance as well, but some cantons allow application after commencement of employment making it possible to start working within a short period of time.

As soon as you know which canton or commune you want to work in, you should get in touch with the appropriate authorities and ask them for details. Most migration departments have a website with information that should answer all your questions. If you still have queries, you can also find their contact information on the site.

The cross-border permit G is valid for five years if you have a permanent contract of employment.

Where are the border regions in Germany?

As mentioned above, to officially be a cross-border worker, you must live in the border region and prove this with a registration certificate from your German commune. Which areas qualify as „border region“ is decided by the Swiss canton and, in some cantons, even by the cities and communes. The border region generally encompasses an area of 100 to 150 km from the border. For instance, if you live in Constance, you can commute across the border to Zurich, but not to Berne.

What about tax and social security contributions?

If you are employed in Switzerland, that is where you pay social security contributions. Contributions to the AHV (state pension and disability insurance) are the most important; you will pay 5,15% of your salary toward this. Added to this are the 1,10% for unemployment insurance and 3 to 9% for the pension scheme.

Paying into a pension scheme is obligatory in Switzerland. This is to guarantee an adequate income that is more than just the state pension upon retiring. Many employers match your contribution with a contribution of their own and you can take the latter out upon leaving Switzerland. Your contribution, however, remains in Switzerland and can only be taken out when you are pensioned. An earlier pay out is only possible if you are not employed and thus paying social security three months after leaving Switzerland. If you have been working for a longer period as a cross-border worker in Switzerland, seek advice before returning to Germany. The BVG security fund in Bern can give you advice on what to do about your pension fund.

Additionally, a sum of approximately 2% for a non-occupational accident insurance and a hospital cash insurance may be subtracted from your salary.

There are two ways in which you can pay tax on your salary. If you can prove that you pay tax in Germany, you will have to pay a withholding tax of 4,5%. You must obtain a form from your Swiss employer which must then be filled in by the tax authorities in your place of residence. Should you fail to submit this form, you will be taxed just like any other Swiss worker. This may or may not be a good thing, depending both on the canton you work in and your personal circumstances. For instance, if you are unmarried with no children, Swiss tax is lower than in Germany. If you choose this form of taxation, it will be taken off your salary as withholding tax and the German tax authorities are not informed immediately. However, you are legally obliged to submit an income tax declaration to them at the end of the year and your income in Switzerland will be taxed retroactively. The withholding tax is counted against your German tax liability.

What about health insurance?

If you work in Switzerland, you must have a health insurance. As a German cross-border worker, you can choose to remain insured in Germany or take out a Swiss health insurance. If you are single, the latter option is often cheaper; people with spouses and children are usually better off with a German health insurance. Insurance premiums must be paid fully out of your own pocket. Contrary to how it is in Germany, your employer (unless specifically agreed upon in your contract) will not pay any part of your premium.

Cross-border workers should also integrate

Even though cross-border workers live in Germany, they do spend more than eight hours a day in Switzerland. As they work in a Swiss environment, it is particularly important that they adapt to Swiss norms and etiquette in order to avoid social blunders.

Companies really appreciate it when their employees understand and even speak Swiss German as managers generally dislike having to hold presentations in Standard German.

We can help: